As a benchmark of where the highest concentrations of capital are moving, new research from (IFSWF) shows that institutional risk across asset classes is improving, particularly for foreign exchange, commodity-sensitive assets and equity reallocation.

The joint report released on Thursday shows that many sovereign wealth funds and institutional investors have been reallocating cash reserves and adding more exposure to risk assets as markets have rebounded. SWFs often have similar investment time horizons to family offices, so the behavior of such entities can be instructive.

There are also insights into sector and regional preferences, shown in some of the charts below.

Equity win, no bubbles just yet

Analysis reveals that sovereign wealth funds invested over $16 billion across 46 equity transactions in 2020, far outweighing the $2 billion invested in 28 deals in 2019.

Many have also used the market turbulence to build up their existing positions in communications and technology, with data from IFSWF revealing that sovereign wealth funds invested $7.4 billion across 30 public direct investments in technology and communications in 2020. This more than triples the $2 billion (across 22 investments) made in 2019, and 12 deals worth $1 billion made in 2018.

The report was drawn from datasets capturing aggregated capital flows, portfolio positions and behavior of long-term institutional investors representing more than $38 trillion in assets managed at State Street.

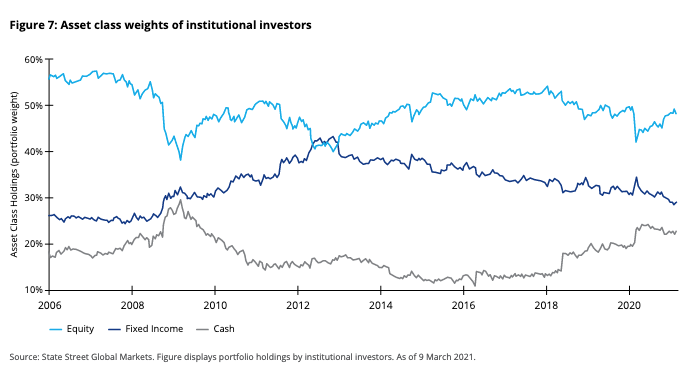

“Long-term investors have made risk-positive reallocation decisions across asset classes, reducing cash holdings and increasing equity exposure, while also continuing to diversify their portfolios by increasing allocations to private assets,” Neill Clark, head of State Street Associates for EMEA, said.

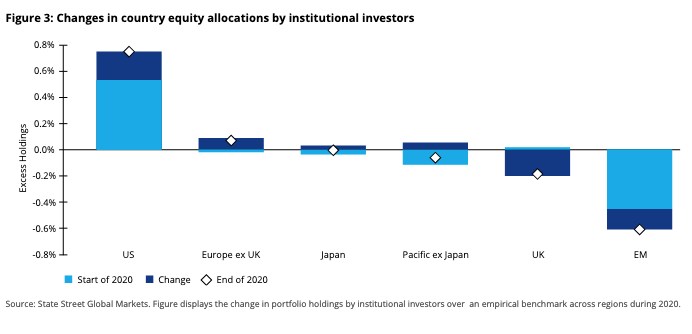

“There was a marked uptick in institutional investor appetite for US listed stocks," he said. Clark said the current macroeconomic environment, anticipated fiscal stimulus and portfolio positioning of institutional investors and sovereign wealth funds all count for "reasons to be optimistic as we move further into 2021."

The UK was seen as value territory, attracting $4.4 billion from sovereign funds in 2020, up from $1 billion invested the previous year. Almost two-thirds of this was in private markets, as some sovereign funds looked for bargains in the UK’s hard hit economy, which contracted10 per cent in 2020.

The chart below shows how asset allocation has changed between equities, cash, and fixed income, and reveals that cash is still holding a cautious line.

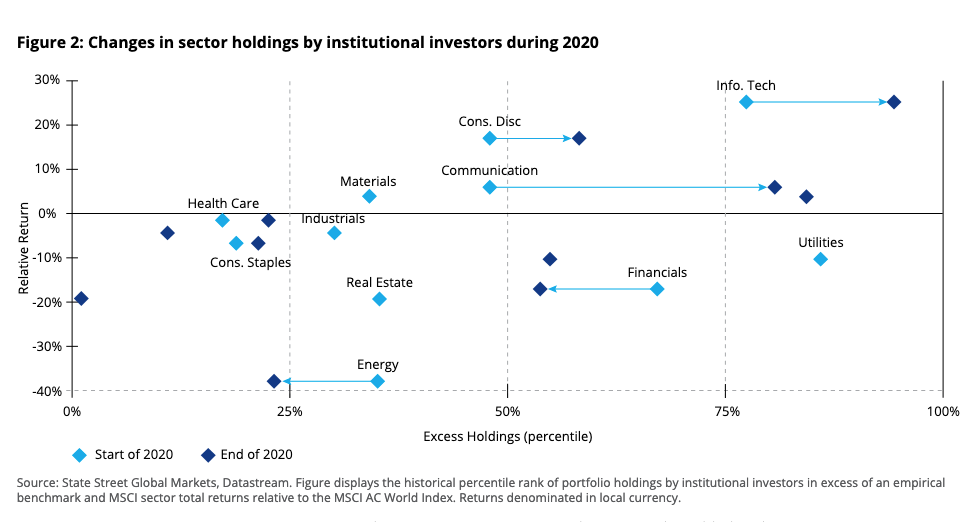

Energy and finance lagging

For institutional investors, the energy and financial sectors were seen as poor performers during the pandemic. Changes in sector holdings for 2020 are shown in the chart below.

IFSWF data shows that sovereign wealth funds invested just $1 billion in the energy sector in 2018 and 2019 and investments in financial services have been declining since 2017.

However, the fortunes of both improved in 2020. The report found that energy in particular received a boost from Saudi Arabia’s Public Investment Fund (PIF) taking positions in energy and financial services companies in the second quarter.

Institutional investors also scaled back investment in emerging markets. For sovereign wealth funds, the trend seemed largely confined to listed strategies.

The chart below shows how institutional money has shifted during the crisis.

Institutional investors and sovereign wealth funds have both been allocating more into private assets. Pumping additional capital into private market investments has been the key to their success in a downturn, investors told the report.

“During the pandemic, sovereign wealth funds have leveraged their long-term investment horizons to take advantage of market dislocations,” Duncan Bonfield, chief executive of IFSWF, the global network of sovereign wealth funds which provided data for the report, said.

“This research also reveals that SWFs continue to seek out sectors, such as technology and healthcare, that have performed strongly during the pandemic, particularly in private markets, where return profiles align with their multi-year investment approaches. This behavior underlines their institutional discipline and focus on long-term returns,” Bonfield said.

How did private assets actually perform?

According to State Street’s Private Equity Index, global private equity returns were down by more than 10 per cent in the first quarter of 2020; the lowest internal rate of return seen since the global financial crisis, and particularly evident in buyouts and private debt. However, they quickly rebounded, gaining around 10 per cent in the second and third quarters, with venture capital investments posting the strongest performance across strategies during the period. (Figure 4 below shows how the market has returned over 15 year years.)

.png)

State Street's daily analysis of media activity also showed that asset-bubble discussions were top of mind causing heightened awareness, but there was no evidence that equity markets are currently in bubble territory.

“In fact, there is further room for institutional investors to add to positions in risk assets,” State Street said.

While many interviewed for the report said they were not worried about asset bubbles in a market that "is not yet there", they did agree that “portions of the global markets appear to be in or close to what one would consider bubble conditions” and therefore “financial assets do appear fully priced to expensive."

Some also raised concern about the “number of Special Purpose Aquisition Company (SPAC) IPOs, the number of technology companies trading at more than 20 times revenues, the multiples that private equity funds are paying for deals, and the proportion of Russell 2000 companies that are unprofitable.”